The post What is the liability to equity ratio of chester? first appeared on Modern Colours.

]]>

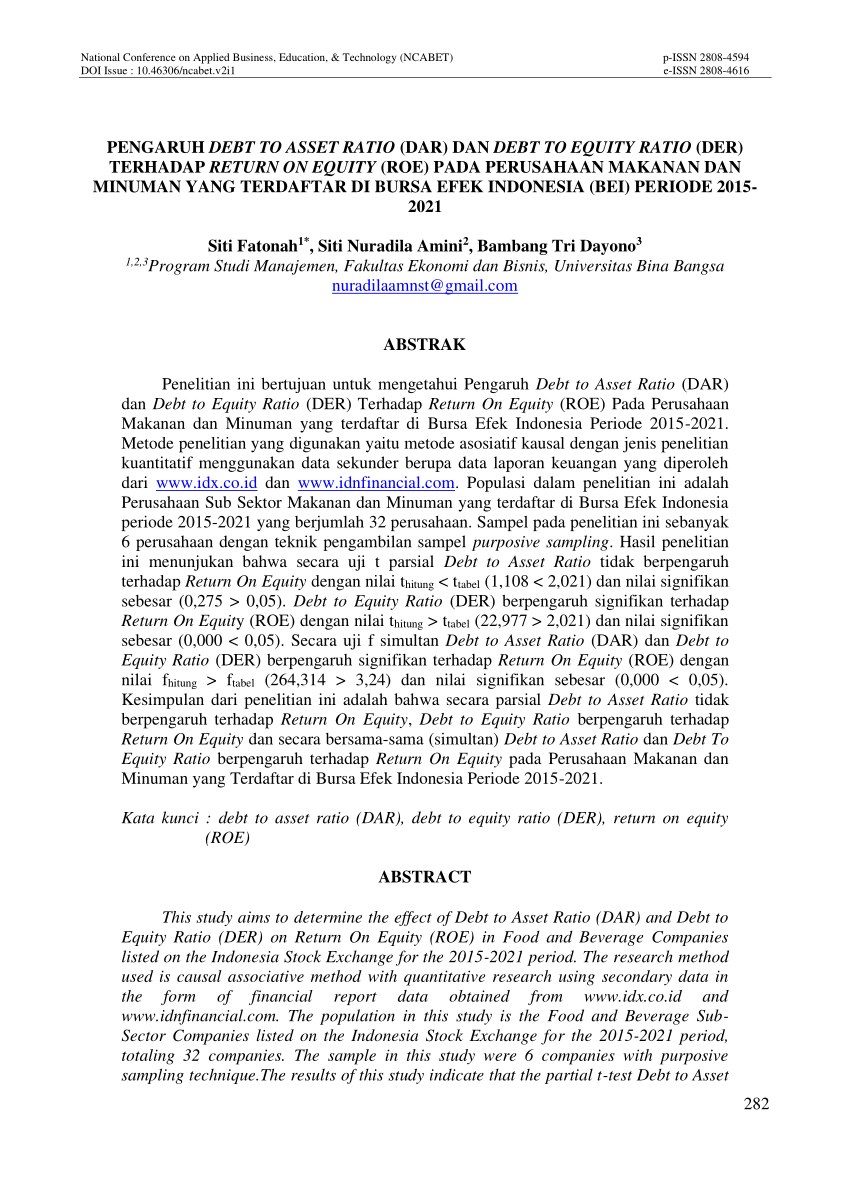

This ratio is a measure of a company’s financial leverage, and it is calculated by dividing the company’s total liabilities by its total equity. A high liability to equity ratio can indicate that a company is taking on too much debt, which can increase its risk of financial distress. The liability to equity ratio is a financial metric boston tax dispute attorney that measures the proportion of a company’s total liabilities to its total equity. It provides insights into the company’s financial leverage and its ability to meet its debt obligations. To calculate Chester’s ratio, we need to gather data on the company’s total liabilities and total equity from its financial statements.

What is the Liability to Equity ratio of Chester? 1.31 .38 1.81 2.55

- In this article, we will discuss the liability to equity ratio in more detail, and we will provide a step-by-step guide to calculating this ratio for Chester.

- A liquidity position means the ability of the company to pay short-term debts.

- Both the elements of the formula can be obtained from company’s balance sheet.

- Petersen Trading Company has total liabilities of $937,500 and a debt to equity ratio of 1.25.

- We will also discuss the factors that can influence a company’s liability to equity ratio, and we will compare Chester’s ratio to industry benchmarks.

Creditors generally like a low debt to equity ratio, because it ensures that the firm is not already heavily relying on debt which ultimately indicates a greater protection to their funds. A significantly low ratio may, however, also be found in companies that reluctant to take the advantage of debt financing for growth. To assess Chester’s financial health, it’s helpful to compare its liability to equity ratio to industry benchmarks. Conversely, a low liability to equity ratio can indicate that a company is not using enough debt, which can limit its growth potential. The lender of the loan requests you to compute the debt to equity ratio as a part of long-term solvency test of the company.

What Is The Liability To Equity Ratio Of Chester

In this article, we will discuss the liability to equity ratio in more detail, and we will provide a step-by-step guide to calculating this ratio for Chester. We will also discuss the factors that can influence a company’s liability to equity ratio, and we will compare Chester’s ratio to industry benchmarks. Petersen Trading Company has total liabilities of $937,500 and a debt to equity ratio of 1.25. The factors that can influence a company’s liability to equity ratio include the company’s industry, its size, its growth rate, and its profitability.

Examples of debt to equity ratio

It shows the relation between the portion of assets financed by creditors and the portion of assets financed by stockholders. The liability to equity ratio measures the gearing risk or leverage of the company. It measure the degree to which a company is financing its operations with debt. Liquidity ratios show the short-term liquidity position of the company. A liquidity position means the ability of the company to pay short-term debts.

Calculating Chester’s Liability to Equity Ratio

Tracking Chester’s liability to equity ratio over time can reveal trends and identify potential areas of concern. A sudden increase in the ratio may indicate excessive debt accumulation, while a steady decline may suggest improved financial stability. Study the quick ratio definition, discover how to interpret the formula, and work through quick ratio examples.

Debt to equity ratio is calculated by dividing total liabilities by stockholder’s equity. A good liability to equity ratio varies depending on the industry in which a company operates. However, a general rule of thumb is that a liability to equity ratio of less than 1 is considered to be healthy.

The numerator in above formula consists of total current and long-term liabilities and the denominator consists of total stockholders’ equity, including preferred stock, if any. Both the elements of the formula can be obtained from company’s balance sheet. Debt to equity ratio (also termed as debt equity ratio) is a long term solvency ratio that indicates the soundness of long-term financial policies of a company.

The post What is the liability to equity ratio of chester? first appeared on Modern Colours.

]]>The post What Is Shareholder Equity SE and How Is It Calculated? first appeared on Modern Colours.

]]>

The ERP should match or exceed the required rate of return set by the investor. It’s calculated using the current treasury bill (T-bill) rate or the long-term yield of government bonds. Due to their government backing, these are considered “safe” or “risk-free” investments. Investors are looking for higher returns, but RF is a good number to use as a baseline for cost-of-equity calculations. The amount of equity awarded to investors is determined by a stock price based on the company’s valuation.

Share This Calculator

Unlike public corporations, private companies do not need to report financials nor disclose financial statements. Nevertheless, the owners and private shareholders in such a company can still compute the firm’s equity position using the same formula and method as with a public one. Equity, also referred to as stockholders’ when do you need a certified public accountant or shareholders’ equity, is the corporation’s owners’ residual claim on assets after debts have been paid. As such, many investors view companies with negative equity as risky or unsafe. However, many individuals use it in conjunction with other financial metrics to gauge the soundness of a company.

What Is the Formula for Equity?

- This calculator streamlines the process of determining shareholders’ equity, making it accessible for stakeholders to assess a company’s financial position quickly.

- At some point, accumulated retained earnings may exceed the amount of contributed equity capital and can eventually grow to be the main source of stockholders’ equity.

- Negative shareholder equity means that the company’s liabilities exceed its assets.

- They include investments; property, plant, and equipment (PPE), and intangibles such as patents.

- All of our content is based on objective analysis, and the opinions are our own.

- It aids in understanding the financial health and value of the company.

As per the formula above, you’ll need to find the total assets and total liabilities to determine the value of a company’s equity. All the information required to compute company or shareholders’ equity is available on a company’s balance sheet. The equity of a company is the net difference between a company’s total assets and its total liabilities.

Shareholders Equity Example

Built to help you elevate your game at work, our courses distill complex business topics — like how to read financial statements, how to manage people, or even how to value a business — into digestible lessons. Our library of 200+ lessons will teach you exactly what you need to know to use it at work tomorrow. Shareholders’ equity is adjusted to account for a number of other items found on the balance sheet, including anticipated gains not yet realized and translation on foreign currency. Founded in 1993, The Motley Fool is a financial services company dedicated to making the world smarter, happier, and richer. The Motley Fool reaches millions of people every month through our premium investing solutions, free guidance and market analysis on Fool.com, top-rated podcasts, and non-profit The Motley Fool Foundation. Successful investors look well beyond today’s stock price or this year’s price movement when they consider whether to buy or sell.

Mining and pharmaceutical companies typically have higher Betas, but they also offer higher potential returns for investors. Shareholders’ equity provides investors a glimpse into the financial health of a company. Typically, the higher or more positive a company’s shareholders’ equity is, the more flexibility or financial cushion it has to absorb losses or pay off debt. Share capital, retained earnings, and treasury shares are all reported in the shareholders’ equity section of a balance sheet.

Long-term liabilities are those that are due for repayment in periods beyond one year and include bonds payable, leases, and pension obligations. Stockholders’ equity is a company’s total assets minus its total liabilities. If a company does not have enough cash flow or assets to cover their liabilities, they are in what is known as “negative equity.” This makes sense as the company’s total stockholders’ equity is the cumulative amount of paid-in capital and retained earnings. Every company has an equity position based on the difference between the value of its assets and its liabilities.

After the repurchase of the shares, ownership of the company’s equity returns to the issuer, which reduces the total outstanding share count (and net dilution). Next, the “Retained Earnings” are the accumulated net profits (i.e. the “bottom line”) that the company holds onto as opposed to paying dividends to shareholders. Shareholders’ equity is the residual claims on the company’s assets belonging to the company’s owners once all liabilities have been paid down.

Negative equity can also occur when there is not enough money realized from sales to cover the company’s debt obligations. Retained earnings grow in value as long as the company is not distributing them to shareholders and only investing them back into the business. Paid-in capital also referred to as stockholders’ funds, is the amount of money that people have invested in a company. Stockholders’ equity is also referred to as shareholders’ or owners’ equity. When companies issue shares of equity, the value recorded on the books is the par value (i.e. the face value) of the total outstanding shares (i.e. that have not been repurchased). Pareto Labs offers engaging on demand courses in business fundamentals.

The CAPM formula uses the risk-free rate of return (RF), the expected market rate of return (MRR) for the next year, and the investment’s Beta (β). It uses the current market value (CMV), dividends per share (DPS), and dividend growth rate (GRD). The stockholders’ equity, also known as shareholders’ equity, represents the residual amount that the business owners would receive after all the assets are liquidated and all the debts are paid. Shareholder equity is also known as the book value of the company and is derived from two main sources, the money invested in the business and the retained earnings.

The shareholders’ equity is the remaining amount of assets available to shareholders after the debts and other liabilities have been paid. The stockholders’ equity subtotal is located in the bottom half of the balance sheet. Investors and analysts look to several different ratios to determine the financial company.

The post What Is Shareholder Equity SE and How Is It Calculated? first appeared on Modern Colours.

]]>The post Meaning of BS, CF, and IS in Accounting Elaborate Description of the 3 Terms first appeared on Modern Colours.

]]>

The accounting procedure for dealing with treasury stock is very important to understand. When treasury stock is repurchased from investors it has the effect of reducing stockholders equity that is recorded on the balance sheet therefore making it negative stockholders equity. Accountants help businesses maintain accurate and timely records of their finances. Accountants also provide other services, such as performing periodic audits or preparing ad-hoc management reports. In Note 6 to the financial statements on page 56, we see there were in fact four million shares issued to employees as part of their non-cash compensation.

Preferred shares

The effect of choosing one accounting method over another is apparent when periodic financial results involving the income and cash flow statement are compared. Each method highlights the individual costs, which fall into the categories of acquisition, exploration, development, and production, differently. However, such a comparison also points out the impact on periodic results caused by differing levels of capitalized assets under the two accounting methods. When the surplus or the profit made by the firm is not distributed to the shareholders as dividends but instead used to invest back in the money is known as retained earnings. RE is used for debt servicing, purchase of a fixed asset, or working capital funding.

Year-End Year-Round Tax Planning Guide

Its use in organizing business transactions and meeting regulatory requirements makes it a field that requires extensive knowledge and study. Generally speaking, however, attention to detail is a key component in accountancy, since accountants must be able to diagnose and correct subtle errors or discrepancies in a company’s accounts. The ability to think logically is also essential, to help with problem-solving. Mathematical skills are helpful but are less important than in previous generations due to the wide availability of computers and calculators.

Key elements in a cash flow statement

In cost accounting, money is cast as an economic factor in production, whereas in financial accounting, money is considered to be a measure of a company’s economic performance. Shareholder equity (SE), also known as stockholders’ equity, is the net worth of the company that belongs to its shareholders. It reflects the residual value of the company’s assets after all liabilities have been what is se in accounting settled. Let’s assume that ABC Company has total assets of $2.6 million and total liabilities of $920,000. Analyzing changes in cash flow from one period to the next gives the investor a better idea of how the company is performing, and whether a company may be on the brink of bankruptcy or success. The CFS should also be considered in unison with the other two financial statements.

What Can Shareholder Equity Tell You?

When the client pays the invoice, the accountant credits accounts receivables and debits cash. Double-entry accounting is also called balancing the books, as all of the accounting entries are balanced against each other. If the entries aren’t balanced, the accountant knows there must be a mistake somewhere in the general ledger. Larger companies often have much more complex solutions to integrate with their specific reporting needs. Some accounting software is considered better for small businesses such as QuickBooks, Quicken, FreshBooks, Xero, or Sage 50.

The formation of the institute occurred in large part due to the Industrial Revolution. Merchants not only needed to track their records but sought to avoid bankruptcy as well. Accounting history dates back to ancient civilizations in Mesopotamia, Egypt, and Babylon. For example, during the Roman Empire, the government had detailed records of its finances.

- Shareholder equity is one of the important numbers embedded in the financial reports of public companies that can help investors come to a sound conclusion about the real value of a company.

- Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology.

- Most businesses view preferred shares as debt with a tax disadvantage (dividends do not reduce taxable income).

- In the accounting equation, every transaction will have a debit and credit entry, and the total debits (left side) will equal the total credits (right side).

- The direct method and the indirect method are both used to calculate cash flow.

During difficult times shareholder equity statement can be very beneficial for knowing if the business has made enough for sustaining its operations. It also enables to check if the equity is enough to handle an unavoidable situation like the covid 19 pandemics. The shareholders’ equity number is a company’s total assets minus its total liabilities. Assets represent the valuable resources controlled by a company, while liabilities represent its obligations.

Number of shares includes, but is not limited to, shares issued for services contributed by vendors and founders. Retained earnings, also known as accumulated profits, represents the cumulative business earnings minus dividends distributed to shareholders. Long-term assets are the value of the capital assets and property such as patents, buildings, equipment and notes receivable.

Managerial accounting also encompasses many other facets of accounting, including budgeting, forecasting, and various financial analysis tools. Essentially, any information that may be useful to management falls under this umbrella. However, lenders also typically require the results of an external audit annually as part of their debt covenants. The Alliance for Responsible Professional Licensing (ARPL) was formed in August 2019 in response to a series of state deregulatory proposals making the requirements to become a CPA more lenient.

The post Meaning of BS, CF, and IS in Accounting Elaborate Description of the 3 Terms first appeared on Modern Colours.

]]>Unit Pricing: A Guide to Understanding and Applying It

An employee’s ...

The post Computation of Unit Cost Under Activity-Based Costing Steps first appeared on Modern Colours.

]]>

It enhances transparency in pricing, enabling individuals to get the best value for their money and organizations to optimize their procurement strategies. By understanding and utilizing unit pricing, one can navigate the market more efficiently and make choices that align with their needs and budget. To calculate the cost of a unit, divide the total cost (including relevant expenses) by the total number of units produced or purchased.

Unit Pricing: A Guide to Understanding and Applying It

An employee’s hourly wages are a variable cost; however, that employee was promoted last year. The current variable cost will be higher than before; the average variable cost will remain something in between. The cost to package or ship a product will only occur if a certain activity is performed.

Differences Between Cost Center and Cost Unit

- Unit costs will vary over time and as the scale of a business’ operation changes.

- Economies of scale happen when the cost per unit decreases as production volume increases.

- The phenomenon is especially evident in B2B scenarios, where bulk orders can lead to cost advantages.

- The former are the salaries paid to those who are directly involved in production, while the latter are the cost of materials purchased and used in production.

- A production cost center refers to a cost center that is engaged in regular production (e.g., converting raw materials into finished products).

From setting prices that strike a balance between competitiveness and profitability to optimizing resource allocation, the cost of a unit can be an ultimate savior. Its accurate understanding is essential for steering through the complex web of financial decision-making. Remember, the price of a unit isn’t just a metric – it’s the key to unlocking informed and prudent financial choices.

Which activity is most important to you during retirement?

A company that seeks to increase its profit by decreasing variable costs may need to cut down on fluctuating costs for raw materials, direct labor, and advertising. However, the cost cut should not affect product or service quality as this would have an adverse effect on sales. By reducing its variable costs, a business increases its gross profit margin or contribution margin. Cost per unit equation is a crucial metric in evaluating financial performance. It provides insights into the efficiency of production or service delivery. Monitoring cost per unit helps ensure competitiveness and sustainable financial health.

cost of Production:

They are also critical to the profitability and competitiveness of many businesses. Let us understand the differences between a cost per unit equation and price per unit through the comparison below. Comparing costs across different industries can be challenging due to variations in production processes, resource requirements, and market dynamics. Allocating costs to specific units or products might involve assumptions that don’t accurately represent the actual consumption of resources.

We will look at the case of packaging material for an electronics manufacturer. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

All public companies are required to use the generally accepted accounting principles (GAAP) accrual method of reporting, while many private companies elect to do so. Under GAAP they have the responsibility of recording unit costs at the time of production and matching them to revenues through revenue recognition. Goods-centric companies will file unit costs as inventory on the balance sheet professional at product creation. When the event of a sale occurs, unit costs will then be matched with revenue and reported on the income statement. If a business increases production or decreases production, rent will stay exactly the same. Although fixed costs can change over a period of time, the change will not be related to production, and as such, fixed costs are viewed as long-term costs.

In short, fixed costs are more risky, generate a greater degree of leverage, and leave the company with greater upside potential. On the other hand, variable costs are safer, generate less leverage, and leave the company with a smaller upside potential. A variable cost is an expense that changes in proportion to how much a company produces or sells. Variable costs increase or decrease depending on a company’s production or sales volume—they rise as production increases and fall as production decreases. For example, the total cost of a cement company is $30,000 to produce 10,000 units, the unit costs of production will be $3 each.

Activity-based costing helps in allocating cost to activities that are value-added. It also improves operational efficiency and enhances decision-making through better, more meaningful cost information. For example, if a company produces and sells 2,000 units for a sale price of $10 and a per-unit cost is $8 for each unit. The unit cost or breakeven point is the minimum amount of price at which a company should sell their product to avoid losses. In a manufacturing company, calculating these figures may be a little tricky but it becomes difficult in case of the service industry as it is difficult to identify a unit for services rendered. Unit costs are a key indicator of the efficiency and productivity of a business.

The company faces the risk of loss if it produces less than 20,000 units. However, anything above this has limitless potential for yielding benefits for the company. Therefore, leverage rewards the company for not choosing variable costs as long as the company can produce enough output. When the manufacturing line turns on equipment and ramps up production, it begins to consume energy. When it’s time to wrap up production and shut everything down, utilities are often no longer consumed.

If these costs increase at a rate that exceeds the profits generated from new units produced, it may not make sense to expand. A company in such a case will need to evaluate why it cannot achieve economies of scale. In economies of scale, variable costs as a percentage of overall cost per unit decrease as the scale of production ramps up. Variable costs are directly related to the cost of production of goods or services, while fixed costs do not vary with the level of production. Variable costs are commonly designated as COGS, whereas fixed costs are not usually included in COGS. Fluctuations in sales and production levels can affect variable costs if factors such as sales commissions are included in per-unit production costs.

The post Computation of Unit Cost Under Activity-Based Costing Steps first appeared on Modern Colours.

]]>What Is a Breakeven Point?

As you can see, the list is exhaustive and relevant to the food truck business. ...

The post Break Even Analysis: the Formula and Example first appeared on Modern Colours.

]]>

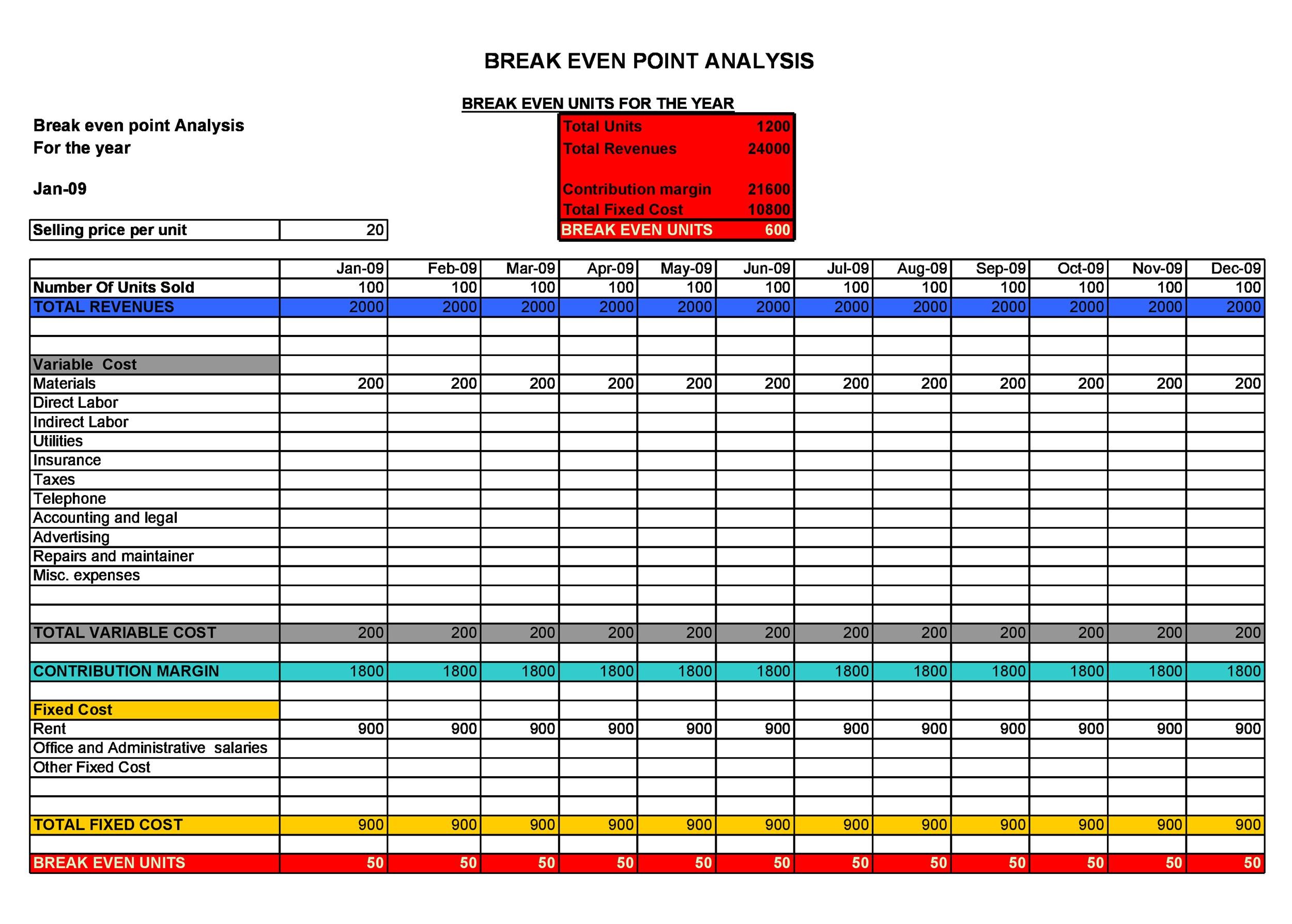

This means that the only thing holding back your ability to break even is how fast you sell your units. Upmetrics business planning app helps you calculate and evaluate the break-even for your complex business processes with utmost ease. Its guided approach, AI-powered functionality, and automated detailed forecasts make it easier even for the new planners to calculate break-even.

What Is a Breakeven Point?

As you can see, the list is exhaustive and relevant to the food truck business. You may consider this as a checklist to ensure that you don’t leave behind any important expense stream. With this blog post, we will explain how to perform break-even analysis and how to reach your break-even faster with examples. Head over to our small business guide on setting up a new business if you want to know more. So, if you are tired of your nine-to-five and want to start your own business, or are already living your dream, read on. Building your own small business is one of the most exciting, challenging, and fun things you can do in this generation.

- Let’s say you are thinking about changing your business model; for example, switching from buying inventory to doing drop shipping or vice-versa, you should do a break-even analysis.

- It’s also important to keep in mind that all of these models reflect non-cash expense like depreciation.

- Even better, you can source from local providers to reduce transportation costs.

- Every business must develop a break-even point calculation for their company.

- One limitation of break-even analysis is that it assumes selling prices will stay the same over time.

Calculate Break-Even Point by Sales Dollar – Contribution Margin Method

In order to help you advance your career, CFI has compiled many resources to assist you along the path. For instance, it’s the Marketing department’s task to offer the closets in an attractive way using various channels, including shops, online shops, is bookkeeping hard to learn all your questions answered design magazines and so on. It might be impossible for the Sales department to sell more than 350 of these closets. If your cost for office space can be lowered, check to see what impact this has on the break-even points of your product(s).

Calculating the break-even point in sales dollars

Yes, service-based businesses can apply the concept of break-even analysis. Here, instead of focusing on the number of units sold, break-even focuses on factors like client hours, project hours, or service contracts as their units for calculation. Another way to reach break-even faster is by raising the average selling price of your products. Similarly, let’s calculate break even at an average selling price of $11. This formula gives you the total number of units you should sell (sales volume) to reach a break-even point. This gives you the number of units you need to sell to cover your costs per month.

Additional Resources

Additionally, it focuses solely on profitability, overlooking cash flow and long-term financial health. The purpose of a break-even analysis is to determine the point at which a business’s revenue equals its total costs, meaning no profit or loss is made. It helps businesses understand the minimum sales needed to cover expenses. The break-even point is where an asset’s market price equals its original cost.

Great, we have special savings for organizing your business ideas.

This lets them know how much product they need to sell to cover the cost of doing business. As you can see, the Barbara’s factory will have to sell at least 2,500 units in order to cover it’s fixed and variable costs. Anything it sells after the 2,500 mark will go straight to the CM since the fixed costs are already covered.

For instance, if management decided to increase the sales price of the couches in our example by $50, it would have a drastic impact on the number of units required to sell before profitability. They can also change the variable costs for each unit by adding more automation to the production process. Lower variable costs equate to greater profits per unit and reduce the total number that must be produced. The break-even point is the volume of activity at which a company’s total revenue equals the sum of all variable and fixed costs. The break-even point is the point at which there is no profit or loss. Assume a company has $1 million in fixed costs and a gross margin of 37%.

It clarifies the relationship between sales, costs, and profits enabling the businesses to set realistic targets. Break-even analysis helps strategize your pricing, allowing reasonable room for margin. It enables you to evaluate pricing and sales under different situations, helping you set a reasonable pricing strategy for your products/services. It’s also important to keep in mind that all of these models reflect non-cash expense like depreciation.

They might also reveal that you could benefit from taking out a small business loan or otherwise accessing more funding. Now, it’s easy to lower fixed costs, especially when you’re starting a new business. To clarify, fixed costs are the ones that remain consistent regardless of the sales volume. Break-even analysis offers a quick snapshot of the business’s financial health.

The hard part of running a business is when customer sales or product demand remains the same while the price of variable costs increases, such as the price of raw materials. When that happens, the break-even point also goes up because of the additional expense. Aside from production costs, other costs that may increase include rent for a warehouse, increases in salaries for employees, or higher utility rates. When you outsource fixed costs, these costs are turned into variable costs. Variable costs are incurred only when a sale is made, meaning you only pay for what you need.

The post Break Even Analysis: the Formula and Example first appeared on Modern Colours.

]]>The post Temporary Accounts: Definition and Examples Explained in Detail first appeared on Modern Colours.

]]>In closing, the accurate recording and management of accounts payable and notes payable are vital components of a successful financial strategy. Ensuring proper handling of these two aspects will contribute to a company’s overall financial health and stability, benefiting both the company and its stakeholders. These examples show the practical application of accounts payable and notes payable in everyday business scenarios. Understanding the differences between the two is essential for accurate financial record-keeping and decision-making. Parent companies, individual owners or others could make a loan to a company that would result in a note payable.

- Dividends paid to shareholders are also recorded in a temporary account, specifically the dividend account.

- They include asset accounts, liability accounts, and capital accounts.

- Your year-end balance would then be $55,000 and will carry into 2023 as your beginning balance.

- As a result, income statement accounts are transient and must be closed on a regular basis.

These accounts are closed at period end and their balances are transferred to the income summary account. Understanding the distinction between temporary accounts and permanent accounts and managing them accordingly is crucial to accurate accounting processes. A single error can throw off the rest of a company’s financial tracking. On the other hand, notes payable refers to a written promise made by a borrower to repay a lender a specific sum of money at is notes payable a permanent or temporary account a specified future date or upon the holder’s demand. Notes payable often involve larger, long-term assets such as buildings and equipment and have both principal and interest components. Appearing as a liability on the balance sheet, notes payable generally have a longer-term nature, greater than 12 months.

Examples of Temporary Accounts

Our solution has the ability to prepare and post journal entries, which will be automatically posted into the ERP, automating 70% of your account reconciliation process. Uncover why real-time data is essential for an efficient continuous close process. Recording these entries in your books helps ensure your books are balanced until you pay off the liability. You create the note payable and agree to make payments each month along with $100 interest. These obligations generally have shorter payment terms, usually within 30 to 90 days.Terms can be longer for large ticket items, custom products or on export transactions. 💡 Unlock the full potential of your business finances with Synder’s COGS tracking.

Efficiency in closing periods

A software company hires a marketing agency on a six-month contract, agreeing to pay the agency $30,000 at the end of the contract period. At the end of the contract, the software company is obligated to pay the marketing agency. This would be classified as accounts payable, a financial obligation from services rendered on credit. Both accounts payable and notes payable share the common aspect of being payable in nature, meaning they involve debts that a company must pay to settle its obligations. Notes Payable, on the other hand, represents a written promise by a company to pay a specific sum of money at a specified future date or upon the demand of the holder who received the note. It is typically used as a liability account to record a debt payback and is issued to banks, credit companies, and other lender.

Permanent — or “real” — accounts typically remain open until a business closes or reorganizes its operations. A balance for a permanent account carries over from period to period and represents worth at a specific point in time. For small and large businesses alike, temporary accounts help accounting professionals track economic activity, manage company finances, and establish a clear record of profit and loss.

FAR CPA Practice Questions: Calculating Interest Expense for Bonds Payable

You must close temporary accounts to prevent mixing up balances between accounting periods. When you close a temporary account at the end of a period, you start with a zero balance in the next period. And, you transfer any remaining funds to the appropriate permanent account. A permanent account is recorded on a company’s balance sheet, which provides a snapshot of what the company owns and owes at a specific point in time.

Notes payable examples

For instance, a long-term prepaid expense might feel like an asset, but it’s typically recorded in a temporary account due to the eventual recognition of the expense. In such cases, generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS) provide guidelines for categorization. Accounting, often referred to as the “language of business,” uses a variety of terms and concepts. Understanding these terms and their implications are crucial for accurate financial reporting and decision making. This article will delve into what these accounts are, how they operate, and their impact on business accounting.

The post Temporary Accounts: Definition and Examples Explained in Detail first appeared on Modern Colours.

]]>Editing just allows you to adjust details like transaction notes and reconciliation ...

The post How to Undo Reconciliation in QuickBooks Online first appeared on Modern Colours.

]]>Considering that, you don’t have the Undo option under the Action column on the Reconciliation page. If you have an accountant, you may invite them to your company so they can accomplish this task on your behalf. Click on the box with the R until it is clear, then click Save. You will get a pop-up warning that your changes could put you out of balance the next time you try to reconcile.

Editing just allows you to adjust details like transaction notes and reconciliation reports. Unreconciliation, however, removes the state of “reconciled” and is actually a reverse of the reconciliation process. So, you’ve gone through and matched up your accounts in QuickBooks, but something just isn’t adding up.

QuickBooks for Small Business: Which Version Do You Need?

Although it’s relatively easy to undo reconciliation in QuickBooks Online, doing so should be a rare exception rather than something you do as a regular part of your bookkeeping process. The process for reconciling these accounts is the same as the process for reconciling a bank or credit card account, and it typically takes only moments to do. Reconciling your accounts is an important step in your business accounting process. Usually, reconciliation signals all the information in your books has been verified against an outside source and the books are ready to be closed for the month.

How to close books in Quickbooks Online and maintain financial security

QuickBooks has a handy built-in backup feature that you’ll definitely want to use for this. The last thing you need is to make some changes and not be able to undo them. See our overall favorites, or choose a specific type of software to find the how to calculate the effective interest rate for discounted bonds best options for you. Now, open the register for the account you are un-reconciling by hovering over Accounting on the left-side toolbar and then selecting Chart of Accounts. When the Chart of Accounts appears, click View Register.

They have this option to ensure your books are in good shape and to avoid messing up your accounts. Look for differences between what’s on your bank statements and what QuickBooks shows as transactions. Now that you’ve reviewed those transactions thoroughly, it’s time to identify any discrepancies or errors lurking around. Also, try never to force a reconciliation by posting to the petty cash accounting Reconciliation Discrepancies account. Only then should you post to the Reconciliation Discrepancies account.

By accessing and using this page you agree to the Terms and Conditions.

- Choose the account and the statement you want to undo reconciliation for, and click View Report.

- Click on “We can help you fix it” to review the transactions you un-reconciled in Step 6.

- Not sure if you have any idea for the new method used for undoing the reconciliation.

- When done correctly, it also helps you prevent fraud in your business.

- Keep in mind, even small changes can unbalance your accounts.

Before completing any of the steps, I suggest consulting with your accountant. This is to make sure that all of your records are in order. I’d be happy to help you unreconcile past bank reconciliation so they don’t throw off your records.

Keep in mind, even small changes can unbalance your accounts. To minimize the impact, you can tip 15 percent only unreconcile one transaction at a time. If you need to completely start over, reach out to your accountant.

Step 1: Review the account

Your accounts should now be balanced and accurate. If you made an adjustment to a past reconciliation or still have problems with your reconciliation, reach out to your accountant. This can get tricky and they know how to handle the next steps. If it’s visible, clear your regular browser’s cache to remove specific issues and help the program run efficiently. Also, you can use other devices and supported browsers to ensure everything works as expected.

Let’s look at four common reasons why you might have to undo reconciliation in QuickBooks Online. In other words, there’s no need — or even any purpose — to reconcile accounts like fixed assets or intangible assets unless there is an outside document you can refer to for reconciliation. Even then, you’ll likely only reconcile non-bank accounts once a year, as in an inventory reconciliation. You’ll get a warning that your account isn’t ready to reconcile because your beginning balance is off by the amount of the transaction or transactions you un-reconciled. Click on “We can help you fix it” to review the transactions you un-reconciled in Step 6. Make sure these match the transactions you meant to un-reconcile.

The post How to Undo Reconciliation in QuickBooks Online first appeared on Modern Colours.

]]>The post Software for Accountants first appeared on Modern Colours.

]]>Clients’ bank feeds imported, expenses reconciled, payroll run, payments recorded, and more. QuickBooks Online Accountant could have earned a better rating if it provided direct phone support without the need for a callback or waiting in a queue. Currently, you have to send a request first, and trial balance an agent will call you back when they are available to assist you. There are two ways you can add a new client in QuickBooks Online Accountant—depending on whether they already have a QuickBooks Online account. QuickBooks Online Accountant is free; and when you enroll, you’re eligible to take part in the QuickBooks Online ProAdvisor program.

Product support

QuickBooks Online Accountant is a cloud-based portal made for accountants and bookkeepers to connect all their clients’ QuickBooks Online accounts. With QuickBooks Online Accountant, they can access all their clients’ company files from one log-in. When you sign up for QuickBooks Online Accountant, you’ll gain access to QuickBooks Online Advanced.

- Get access to everything from discounts to marketing tools and exclusive training with Pro Advisor.

- The QuickBooks ProAdvisor program offers benefits and resources that get better as your firm grows.

- Businesses that provide services, rather than goods, should consider the QuickBooks Plus plan.

- They can run trial balances, export data for taxes, void or delete transactions and reclassify transactions in bulk to save time.

- You get a free subscription to QuickBooks Online with Payroll to manage your own company when you sign up with QuickBooks Accountant.

Work in clients’ books

When you enter clients into your practice, they are automatically added to your Quickbooks as customers. Click Your Books in the navigation bar on the left side of the screen to manage your own firm’s books and payroll. The extensive optional app library allows you to seamlessly add productivity boosting functionality to your technology stack. The integrated apps provide functionality that spans reporting, inventory management, expense qbo accountant management, payroll, eCommerce, and much more.

The efficient way for your clients to thrive

The QuickBooks ProAdvisor program offers benefits and resources that get better as your firm grows. Intuit reports that 94% of accounting professionals feel QuickBooks Online saves them time and thus saves their clients’ money. By using QuickBooks Online Accountant, accountants can add customers to their client list and work on their books through the portal. Accountants love the Accountant Toolbox that puts everything at their fingertips.

Give users client access and permissions

With smart insights just a click away, you’ll always make the right business decisions. QuickBooks Online Accountant isn’t just a portal to your client’s books—it’s the one place to grow and manage your entire practice, at your pace. The first are links to features within QuickBooks Online that are only accessible by accountants. The second is links that anyone can get to, but the Accountant Toolbox is just a way to provide you a quick link to those features. I awarded QuickBooks Online Accountant perfect marks because it comes with free access to QuickBooks Online Advanced that you can use for your own firm.

- Today’s leading accounting platforms offer standard security features like data encryption, secure credential tokenization and more.

- Large businesses that need access for up to 25 users will probably want to go with QuickBooks Advanced.

- The materials feature will help your clients to track the costs of parts, tools and other physical materials.

- For more information about how QuickBooks Online Advanced differs from the other QuickBooks Online plans, read our QuickBooks Online plans comparison.

- If your clients use QuickBooks Desktop, you can also download software and certifications from QuickBooks Online Accountant.

Find tools you love faster

Sage Business Cloud Accounting will review your business needs before giving you a quote, whereas QuickBooks Online Accounting is a per-client charge that is easy to understand. While data and notes are collected and kept on the dashboard, don’t expect QuickBooks Online Accountant to work like a traditional customer relationship management (CRM) software. It is designed to make their accounting a seamless process with your firm, not to track calls and communications. This means that some data may be displayed but not Bookkeeping for Chiropractors always in the most efficient way. Quickly access financial data and accounting reports in an instant with QuickBooks online software for accountants.

- There are self-paced guides to walk you through functions, video recordings to hone your skills and webinars to stay abreast of current changes in the field.

- Click a client’s name in the dashboard to see lots of info about that client.

- Ideally, accounting practice software providers should offer various ways for users to seek support, including phone and email support, self-help guides, and training opportunities.

- With four plans available, there are several options from which to choose, depending on your needs.

- Effortless e-Invoicing with automated solutions from our partner Sovos, the regulatory-compliant cloud-based market leader.

- On the flip side, one user complained that the customer support was a bit unresponsive.

- It also assists with organization, integrating seamlessly with Google Sheets.

- Accountants can sign up their small business clients to QuickBooks Online with special pricing discounts for accountants.

- One particular time-saving feature is the custom bank feeds that help clean up data quickly and accurately.

We checked out online reviews to see if users have positive experiences with the software. We checked not only the initial purchase or subscription fee but also any ongoing costs, such as updates, support, and training. If you drive for work, you can use QuickBooks Online Accountant to record your deductible mileage. With the free QuickBooks mobile app, you can automatically track your business mileage without manually recording your odometer readings. The Trial Balance tool is particularly useful during the preparation of financial statements.

The post Software for Accountants first appeared on Modern Colours.

]]>The post What is Industry Accounting? first appeared on Modern Colours.

]]>You can outsource your accounting work to outside professionals who specialize in bookkeeping and tax preparation. Outsourcing can offer many advantages because it allows you to take advantage of specialized skill sets that may not be available when hiring someone in-house. There are several software programs on the market that allow for optimal management of industrial accounting, however, choosing the best solution may not be as easy as one might think. So let’s take a look at what industrial accounting is used for and what are the benefits of its optimal management.

What Are Accounting Standards?

Accounting software with a retail focus may have tools for managing sales orders and keeping track of inventory levels. Accurate accounting data and reporting depend on the POS and accounting system being integrated. Analysts, managers, business owners, and accountants use this information to determine what their products should cost. In cost accounting, money is cast as an economic factor in production, whereas in financial accounting, money is considered to be a measure of a company’s economic performance. This focuses on the use and interpretation of financial information to make sound business decisions. It’s similar to financial accounting, but this time, it’s reserved for internal use, and financial statements are made more frequently to evaluate and interpret financial performance.

Manufacturers have requirements for supply chain management, inventory management, and tracking production costs. Software for manufacturing accounting may offer features for managing inventory of finished goods, work-in-progress, and raw materials. Manufacturing companies also have an accounting function known as bill of materials, which is tracking the materials used to make products. Point-of-sale (POS) transactions, inventory management, and cash handling are common issues for retail businesses.

Cost-Effective Virtual CFO Services for Growing Businesses

Accounting is the process of recording financial transactions pertaining to a business. The accounting process includes summarizing, analyzing, and reporting these transactions to oversight agencies, regulators, and tax collection entities. The financial statements used in accounting are a concise summary of financial transactions over an accounting period, summarizing a company’s operations, financial position, and cash flows. Industrial accounting plays a vital role in business management since it enables the determination of production costs, a key factor in guiding strategic business decisions.

Business

- The Alliance for Responsible Professional Licensing (ARPL) was formed in August 2019 in response to a series of state deregulatory proposals making the requirements to become a CPA more lenient.

- For example, in industries such as healthcare or construction, there are specific accounting principles and practices related to revenue recognition, project costing, and regulatory compliance.

- Professional service providers, including law firms, frequently have time and billing tracking needs.

- Financial accounting refers to the processes used to generate interim and annual financial statements.

- While the culture at every company and firm can be different, industry is generally considered a lower stress environment with more flexibility when compared to public accounting, which can be stressful in order to meet client deadlines.

- Industry accounting is a type of private accounting where one works in the accounting department for a specific company.

Its use in organizing business transactions and meeting regulatory requirements makes it a field that requires extensive knowledge and study. To illustrate double-entry accounting, imagine a business sending an invoice to one of its clients. An accountant using the double-entry method records a debit to accounts receivables, which flows through to the balance sheet, and a credit to sales revenue, which flows through to the income statement. The Securities and Exchange Commission has an entire financial reporting manual outlining the reporting requirements of public companies. Larger companies often have much more complex solutions to integrate with their specific reporting needs.

Hospitals, clinics, and pharmacies that provide healthcare have particular billing and compliance requirements. Features for handling patient billing, filing claims for medical assistance or insurance, and negative confirmation adhering to national healthcare laws are all possible additions to accounting solutions. At Select Recruitment Specialists, we have a team of experienced recruiters who can help you find the right accounting job, whether you’re interested in working in industry or practice.

However, despite their tailored nature, industry-specific accounting software can present challenges and it may not fully meet your business’s unique needs or align with future growth plans, despite being designed for your industry. In conclusion, industry accounting is an essential component of the financial landscape. It enables businesses to meet industry-specific requirements, address unique challenges, and communicate financial information effectively. By employing industry accounting practices, businesses can gain a competitive edge, enhance decision-making, and build trust among shareholders, investors, lenders, and regulatory bodies.

Hopefully these tips will help you determine when, if ever, is the right time for you to make the jump from public accounting to industry. A comprehensive tax planning and preparation firm with years of experience providing honest and trusted advice to privately held businesses and individuals. Utilizing and understanding the industry’s accounts will significantly improve an organization’s operational efficiency and capacity for strategic planning. Our team of professionals understands the unique challenges of each industry, ensuring seamless integration and maximum efficiency.

The post What is Industry Accounting? first appeared on Modern Colours.

]]>The post Contribution Margin: What It Is, How to Calculate It, and Why You Need It first appeared on Modern Colours.

]]>

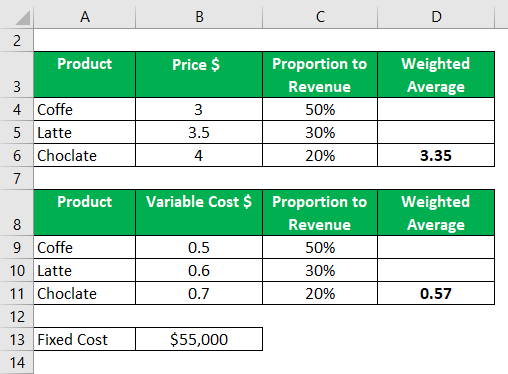

That is, it refers to the additional money that your business generates after deducting the variable costs of manufacturing your products. A business can increase its Contribution Margin Ratio by reducing the cost of goods sold, increasing the selling price of products, or finding ways to reduce fixed costs. A high Contribution Margin Ratio indicates that each sale produces more profit than it did before and that the business will have an easier time making up fixed costs. A low Contribution Margin Ratio, on the other hand, suggests that there may be difficulty in covering fixed costs and making profits due to lower margins on individual sales.

What is the contribution margin ratio formula?

As mentioned above, contribution margin refers to the difference between sales revenue and variable costs of producing goods or services. This resulting margin indicates the amount of money available with your business to pay for its fixed expenses and earn profit. In other words, contribution margin per unit is the amount of money that each unit of your product generates to pay for the fixed cost. Accordingly, the contribution margin per unit formula is calculated by deducting the per unit variable cost of your product from its per unit selling price. The difference between fixed and variable costs has to do with their correlation to the production levels of a company. As we said earlier, variable costs have a direct relationship with production levels.

- The contribution margin can be presented in dollars or as a percentage.

- If they sold 250 shirts, again assuming an individual variable cost per shirt of $10, then the total variable costs would $2,500 (250 × $10).

- The Indirect Costs are the costs that cannot be directly linked to the production.

- In these examples, the contribution margin per unit was calculated in dollars per unit, but another way to calculate contribution margin is as a ratio (percentage).

Business Class

In such cases, the price of the product should be adjusted for the offering to be economically viable. The companies that operate near peak operating efficiency are far more likely to obtain an economic moat, contributing toward the long-term generation of sustainable profits. You need to fill in the following inputs to calculate the contribution margin using this calculator. As you can see, the contribution margin per-unit remains the same. Accordingly, the per-unit cost of manufacturing a single packet of bread consisting of 10 pieces each would be as follows.

Calculate Contribution Margin Ratio

Variable costs are not typically reported on general purpose financial statements as a separate category. Thus, you will need to scan the income statement for variable costs and tally the list. Some companies do issue contribution margin income statements that split variable and fixed costs, but this isn’t common. The contribution margin formula is calculated by subtracting total variable costs from net sales revenue. Thus, the level of production along with the contribution margin are essential factors in developing your business.

Income Statement

The contribution margin may also be expressed as a percentage of sales. When the contribution margin is expressed as a percentage of sales, it is called the contribution margin ratio or profit-volume ratio (P/V ratio). The contribution margin is the amount of revenue in excess of variable costs.

Contribution margin is the variable expenses plus some part of fixed costs which is covered. Thus, CM is the variable expense plus profit which will incur if any activity takes place over and above BEP. Yes, it how to create a business succession plan means there is more money left over after paying variable costs for paying fixed costs and eventually contributing to profits. It means there’s more money for covering fixed costs and contributing to profit.

The contribution margin is the leftover revenue after variable costs have been covered and it is used to contribute to fixed costs. If the fixed costs have also been paid, the remaining revenue is profit. Similarly, we can then calculate the variable cost per unit by dividing the total variable costs by the number of products sold. You need to calculate the contribution margin to understand whether your business can cover its fixed cost. Also, it is important to calculate the contribution margin to know the price at which you need to sell your goods and services to earn profits. It provides one way to show the profit potential of a particular product offered by a company and shows the portion of sales that helps to cover the company’s fixed costs.

Buying items such as machinery is a typical example of a fixed cost, specifically a one-time fixed cost. Regardless of how much it is used and how many units are sold, its cost remains the same. However, these fixed costs become a smaller percentage of each unit’s cost as the number of units sold increases.

The post Contribution Margin: What It Is, How to Calculate It, and Why You Need It first appeared on Modern Colours.

]]>