A low DOL, on the other hand, suggests that a company’s variable costs are higher than its fixed costs. This means that changes in sales have a less dramatic impact on operating income. Companies with low operating leverage experience smaller fluctuations in EBIT with changes in sales. This structure provides stability, as lower fixed costs mean the company doesn’t require high sales volumes to cover its expenses. Operating leverage measures a company’s ability to increase its operating income by increasing its sales volume.

Degree of Operating Leverage: FAQ

- Suppose the operating income (EBIT) of a company grew from 10k to 15k (50% increase) and revenue grew from 20k to 25k (25% increase).

- For each product sale that Walmart rings in, the company has to pay for the supply of that product.

- My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers.

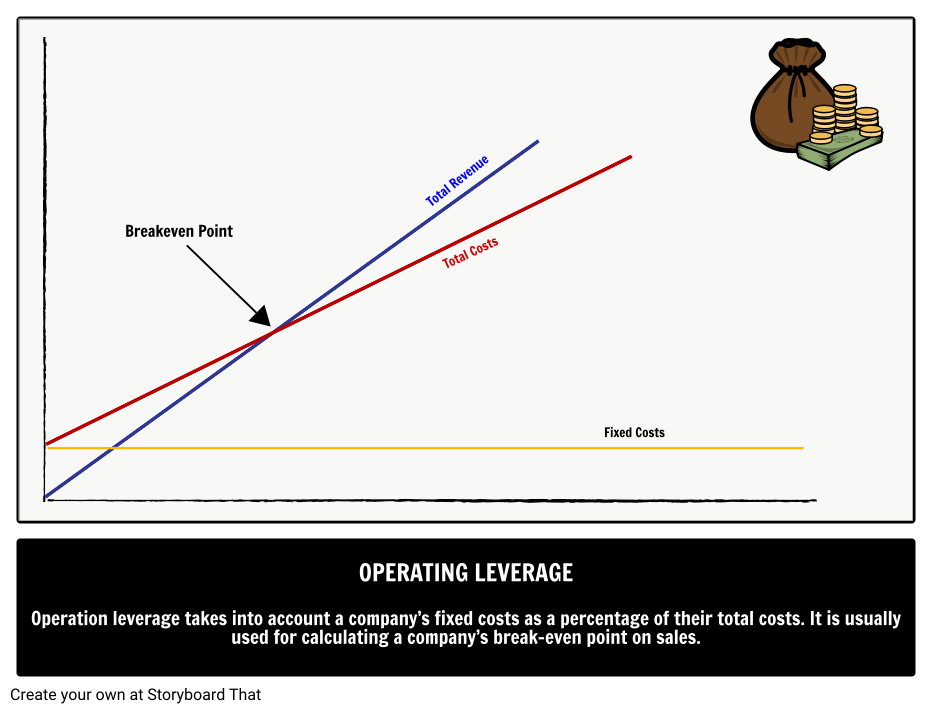

- If a company has high operating leverage, each additional dollar of revenue can potentially be brought in at higher profits after the break-even point has been exceeded.

It is observed that debt financing is cheaper compared to equity financing. When calculating financial leverage, you should note that EBIT is a dependent variable that is determined by the level of EPS. Yes, but ensure you’re comparing companies within the same industry or sector, as operating leverage can vary significantly between different types of businesses.

Formula and Calculation of Degree of Operating Leverage

Most investors, such as private equity firms and venture capitalists, prefer companies with high operating leverage because it makes growth faster and easier. This approach produces 2.0x for the software company vs. 1.0x for the services company, which understates the operating leverage differences. Regardless of whether revenue increases or decreases, the margins of the company tend to stay within the same range. If all goes as planned, the initial investment will be earned back eventually, and what remains is a high-margin company with recurring revenue.

Our Services

The contribution margin represents the percentage of revenue remaining after deducting just the variable costs, while the operating margin is the percentage of revenue left after subtracting out both variable and fixed costs. Intuitively, the degree of operating leverage (DOL) represents the risk faced by a company as a result of its percentage split between fixed and variable costs. In fact, operating leverage occurs when a firm has fixed costs that need to be met regardless of the change in sales volume.

This formula can be used by managerial or cost accountants within a company to determine the appropriate selling price for goods and services. If used effectively, it can ensure the company first breaks even on its sales and then generates a profit. This section will use the financial data from a real company and put it into our degree of operating leverage calculator.

If fixed costs are high, a company will find it difficult to manage short-term revenue fluctuation, because expenses are incurred regardless of sales levels. This increases risk and typically creates a lack of flexibility that hurts the bottom line. Companies with high risk and high degrees of operating leverage find it harder to obtain cheap financing. A high DOL indicates that a company has a larger proportion of fixed costs compared to variable costs.

As a cost accounting measure, it is used to analyze the proportion of a company’s fixed versus variable costs. Managers use operating leverage to calculate a firm’s breakeven point and estimate the effectiveness of pricing structure. An effective pricing structure can lead to higher economic gains because the firm can essentially control demand by offering a better product at a lower price. If the firm generates adequate sales volumes, fixed costs are covered, thereby leading to a profit. The Degree of Operating Leverage (DOL) measures how a company’s operating income responds to changes in sales. It provides insight into the relationship between fixed and variable costs and their impact on profitability.

It is important to compare operating leverage between companies in the same industry, as some industries have higher fixed costs than others. That’s to say, operating leverage appears where there is a fixed financial charge (interest on debt and preference dividend). To calculate both operating leverage and financial leverage, EBIT is referred to as the linking point in the study of leverage. When calculating the operating leverage, EBIT is a dependent variable that is determined by the level of sales.

These industries have higher raw material costs and lower comparative fixed costs. For example, for a retailer to sell more shirts, it must first purchase more inventory. When a restaurant sells more food, it must first purchase more ingredients. The cost of goods sold for each individual sale is higher in proportion to the total sale. For these industries, an extra sale beyond the breakeven point will not add to its operating income as quickly as those in the high operating leverage industry. Unfortunately, unless you are a company insider, it can be very difficult to acquire all of the information necessary to measure a company’s DOL.

Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. These two costs are conditional on past demand volume patterns (and future expectations). Furthermore, accounting, cpa and tax prep houston another important distinction lies in how the vast majority of a clothing retailer’s future costs are unrelated to the foundational expenditures the business was founded upon.

An example of a company with a high DOL would be a telecom company that has completed a build-out of its network infrastructure. The catch behind having a higher DOL is that for the company to receive positive benefits, its revenue must be recurring and non-cyclical. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

JUN

2021

About the Author: